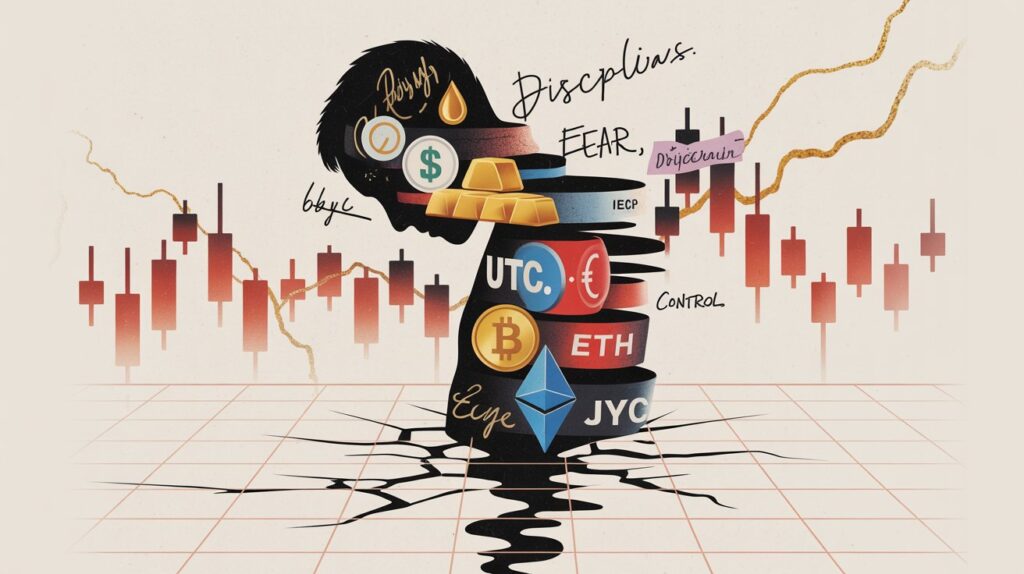

Most traders lose, not because their strategy is wrong, but because their trader mindset is broken. The charts, the indicators, the entry signals, these are the surface of the game. Underneath every consistently profitable trade is a finely tuned trading psychology: a mental operating system built on discipline, probabilistic thinking, and relentless self-awareness.

This is not a theory article. This is a working blueprint, actionable, direct, and built for the realities of today’s markets. Whether you trade equities, forex, crypto, or futures, the winning mindset in trading operates on the same universal principles. Here is how elite traders actually think.

The Trading Mental Game: Why Mindset Beats Strategy Every Time

There is a number every trader needs to sit with: 80% of consistently profitable professional traders cite psychology, not strategy as their primary edge. Your technical analysis can be perfect. Your risk-reward ratio can be textbook. But the moment fear, greed or ego enter the execution, the edge disappears.

The trading mental game is not a soft skill layered on top of real trading. It is the foundation everything else is built on. The professional trader psychology framework starts with one brutal truth: the market is an impartial adversary with no memory of your last trade, no knowledge of your account balance, and zero interest in your financial goals. It simply moves. Your only control is how you respond.

This is where self-awareness in trading becomes a hard performance variable. Traders who track not just their P&L but their emotional state per trade find patterns that no chart can reveal, the specific setups that trigger overconfidence, the account balance thresholds that trigger fear, the days of the week where decision quality drops. Data on yourself is as valuable as data on the market.

Actionable, The Mindset Audit: Before your next session, rate yourself 1–10 on Discipline, Patience, Emotional Neutrality, and Confidence Calibration. If any score falls below 6, reduce position size by 50% that session. Do not negotiate with a compromised mental state.

The Probability Mindset: Thinking in Edges, Not Outcomes

The single greatest cognitive upgrade any trader can make is the shift from outcome-based thinking to probability-based decision making. The amateur trader thinks: “Will this trade win?” The elite trader thinks: “Does this trade have a statistically positive expected value over one thousand executions?”

This is what Mark Douglas called thinking in probabilities, and it is the cornerstone of every professional trader psychology framework. When you genuinely internalize that any single trade is irrelevant, only the consistency of execution over hundreds of trades determines performance, you stop letting individual outcomes destroy your decision-making.

Process over outcomes is not a motivational slogan. It is a technical trading instruction. It means your post-trade review question shifts from “Did I make money?” to “Did I follow my plan exactly?” A losing trade executed perfectly is a success. A winning trade taken off-plan is a failure. This reframe is what separates traders who plateau from traders who compound.

Before every entry, run this three-question check: Is this trade part of my defined edge, the setup I’ve back-tested and proven? Is my risk defined and accepted before I enter? Am I entering because of objective criteria, or because of FOMO, recent results, or an emotional bias? If the answer to any of these creates hesitation, the trade does not get placed.

A 55% win rate with a 1.5R average reward is more powerful than an 80% win rate with a 0.5R reward. Know your expectancy number. Trade it with mechanical consistency. The probability mindset for trading turns a modest edge into compounding performance.

Trader Discipline and Consistency: The Unsexy Truth About Elite Performance

Every trader wants to be disciplined. Almost none of them have a system for building it. Discipline is not willpower. Willpower is finite, context-dependent, and depletes under stress, exactly the conditions that define active trading sessions. Real trader discipline is a set of pre-committed rules that removes the decision entirely.

Trader consistency is the output of structured trading routines and habits, not of talent. The traders who post consistent monthly returns do so because they have systematically eliminated the decisions that emotions could corrupt. Their entry criteria are non-negotiable. Their stop placement is mechanical. Their position sizing is formula-driven. They have nothing left to feel because the plan already decided everything.

Build your non-negotiable rule set now. Maximum loss per trade: fixed percentage, no exceptions. Maximum daily drawdown: session ends when this is hit, no re-entry. Setup criteria: every entry must pass all criteria, no partial qualifiers. Revenge trade protocol: mandatory 30-minute break after any impulsive trade. Position sizing: formula-based only, no sizing up “because this one feels different.”

Discipline and consistency compound. The trader who follows their rules rigorously for 90 consecutive trading days has built something no losing streak can easily destroy: behavioral momentum. The plan becomes the default. Deviation becomes an aberration. This is the elite trading mindset made operational.

Related article: Why discipline beats motivation in trading every time

Trading Emotional Control: Managing Fear, Greed, and the Psychological Triggers Nobody Talks About

Fear and greed are not character flaws. They are evolutionary wiring applied to the wrong environment. Your brain’s loss-aversion circuits, the same ones that kept your ancestors alive are the circuits that make you move a stop loss and turn a small, manageable loss into an account-threatening position. Trading emotional control is the practice of interrupting that ancient wiring and replacing it with deliberate, rule-based responses.

Managing fear and greed starts with recognition, not suppression. Elite traders do not eliminate emotions, that is neurologically impossible. They develop the self-awareness to notice the emotional state, name it, and then act according to their plan rather than the emotion. The gap between stimulus and response is where the super trader lives.

Map your triggers. Fear fires when your account hits a round-number loss, when you enter after a winning streak, or when you trade in unfamiliar volatility conditions. Greed fires when you move profit targets after a big winner, add to positions beyond plan, or ignore warning signals because the trade “feels” strong. Overconfidence fires after three or more consecutive winning trades. Revenge fires after a stop hunt or a missed trade that ran without you. Name them. Track them. They lose power the moment they are identified.

The 3-Breath Rule: Before executing any trade that deviates from your written plan, take three slow, deliberate breaths and ask: “Am I acting on my edge or on an emotion?” This one pause, practised daily, has saved more accounts than any stop-loss strategy ever written.

Read this guide: Emotional Discipline in Trading: How to Stay Calm During Drawdowns

Resilience in Trading: How to Recover from Drawdowns Without Destroying Your Account

Every professional trader, without exception, has sat through periods where the account was bleeding and the strategy felt broken. Resilience in trading is not the absence of loss, it is the trained capacity to absorb loss without compounding it through irrational behavior.

Psychological recovery from drawdowns follows a sequence, not a mood. When you are in drawdown, your brain will generate increasingly compelling arguments for why you should take more risk to recover faster. Recognize this as the survival circuit misfiring. The correct response is the opposite.

Immediate action: cut position size in half. You are not being punished, you are protecting your ability to continue trading. Review phase: audit the losing trades with brutal objectivity. Were you following the plan? If yes, this is variance, continue. If not, this is a behavior problem, address it before re-entering. Rebuild phase: return at minimum size, focus on plan adherence score rather than profit. Five consecutive high-adherence sessions signal readiness to scale back up.

The growth mindset in trading treats a drawdown not as a verdict on your ability, but as data that improves your system. The traders who survive long enough to become elite are not those who avoid all drawdowns, they are those who extract maximum learning from every one they experience.

Related article: How to Rebuild Confidence After Trading Losses

Trading Routines and Habits: The Daily Architecture of a Professional Trader

Mindset is not something you have. It is something you practice. The psychological preparation before the market opens is as important as any technical analysis. Here is the daily architecture that separates professional trader psychology from amateur decision-making.

Thirty minutes before the session: five minutes of breathwork or meditation, review your trading plan, mark your key levels, and write one specific behavioral intention for the day, not a profit target, a behavior target. At market open: observe the first fifteen minutes before entering. Patience and waiting for setups is not passivity, it is selective aggression. Only enter when your full setup criteria are confirmed.

During the session: rate your emotional state every sixty minutes on a 1–10 scale. Below 6 means a mandatory ten-minute break before your next trade. After the session: journal every trade, entry rationale, plan adherence score, emotional state, and one lesson. Complete the adherence review before you look at the P&L. In the evening: physical reset, no market content after 7PM. Your edge compounds while you sleep if your system is built correctly.

Trade journaling mindset is the highest-leverage habit available to any developing trader. Most journals track what happened. Elite journals track why it happened and what the emotional state was that drove the decision. That is where the real patterns live.

The Risk Management Mindset: Capital Preservation as a Trading Philosophy

Amateur traders think about how much they can make on a trade. Elite traders think about how much they can lose and whether that loss is fully acceptable before a single dollar of risk is committed. This is the risk management mindset, and it is the single most transformative belief shift a developing trader can make.

Risk-first thinking means that position size, stop placement, and daily max loss limit are not afterthoughts. They are the first decisions made on every trade, calculated before the entry, and committed without the option of negotiation once the trade is live.

The market volatility mindset extension of this principle means treating volatility as information, not as threat. When market conditions shift, wider spreads, gapping price action, reduced liquidity, the professional trader adjusts position size down, not conviction up. The market does not owe you a clean exit. Size accordingly.

The 1% rule: never risk more than 1% of total account equity on any single trade. This is not conservative, it is a survival strategy that keeps you in the game long enough for your edge to manifest. Twenty consecutive maximum losses would still leave 82% of your capital intact. You cannot be profitable if you cannot stay in the game.

Read this article: Why You Keep Selling Your Winners and Holding Your Losers

The Reborn Trader Takeaway: Mindset Is the Strategy

The difference between the professional and amateur trader mindset is not intelligence, not access to better data, and not a proprietary algorithm. It is the disciplined, daily application of a mental operating system that prioritizes process over outcomes, probability over prediction, and patience over impulse.

Every pillar in this article, self-awareness, probability thinking, emotional control, resilience, disciplined routines, and risk-first decision-making, is trainable. It is not who you are born as. It is who you choose to build yourself into, session by session, trade by trade, journal entry by journal entry.

The Reborn Trader does not chase markets. The Reborn Trader commands the one thing the market cannot touch: their own mind. That is the edge. That has always been the edge.

Start your trade journal tonight. One session. One entry. Rate your discipline, your patience, and your emotional neutrality. Do it again tomorrow. That’s how the Reborn Trader is built.

Ready to Master Your Trading Psychology?

If you’re serious about becoming a consistently profitable trader, you need to understand the complete psychological landscape that separates amateurs from professionals.

Join The Reborn Trader Premium Newsletter, every sunday morning, I break down one critical aspect of trader psychology with research-backed strategies you can implement immediately. No generic advice, just the psychological edge that separates the top 5% from everyone else.

Subscribe to The Reborn Trader Premium Newsletter

FAQ

How do I stop letting emotions control my trading?

Replace emotional decisions with pre-committed rules written before the session starts, entry criteria, position size, and maximum loss, all locked in before a single trade is placed. When the rules decide, your emotions have nothing left to override. Support this with a daily mindset audit and a mandatory break after any impulsive trade. The goal is not to feel nothing, it is to build a system your feelings cannot touch.

What separates a professional trader mindset from an amateur one?

The amateur focuses on whether individual trades win or lose and blames the market when they don’t. The professional focuses entirely on whether the plan was followed and takes full ownership of every result. One trades outcomes, the other trades process and process is the only thing a trader can actually control. That single shift in focus is the entire mindset gap.

How long does it take to develop a superpower trader mindset?

Most traders see real, measurable improvement within three to six months of consistent daily practice, journaling, pre-market routines, and honest post-session reviews. The fastest path is to isolate your single biggest psychological weakness and make it your exclusive focus for 30 days. Mindset development compounds exactly like a trading edge, small daily inputs produce outsized long-term results. Show up every session and the progress is inevitable.

Is risk management a strategy or a mindset?

Risk management is a mindset first and a strategy second, you can know every rule ever written and still move your stop out of hope or size up out of greed. The real shift happens when you genuinely believe that protecting your capital matters more than recovering yesterday’s losses. Once that belief is internalized, the 1% rule stops feeling like a restriction and starts feeling like armor. You cannot win if you are not still in the game.