It started with a $2,000 account and a stock nobody had heard of. Marcus, a 27-year-old warehouse worker from Ohio, stumbled onto a trading forum in January. Someone posted a ticker, a penny stock trading at $0.34. The thread was electric. “This thing is going for $3,” someone wrote. “Easy 10x.”

Marcus bought 5,000 shares. By Thursday, the stock hit $0.91. He doubled down.

By the following Friday, his $2,000 had become $6,800. He screenshotted his portfolio. He posted it. The comments flooded in. “You’re a natural.” “You’ve got the touch.” He quit his overtime shifts. He told his girlfriend he might not need his job much longer.

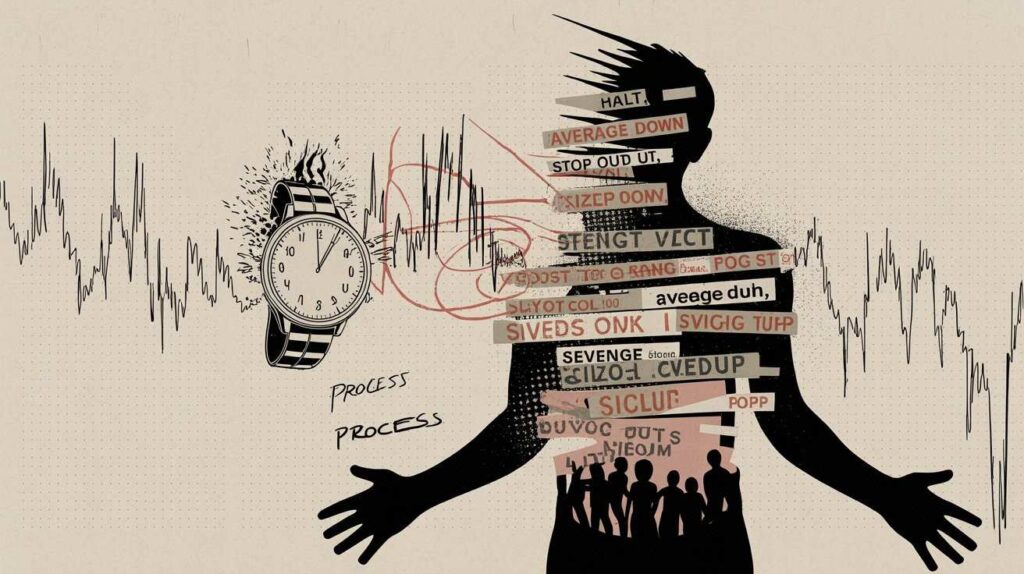

Then came the halt. The stock was suspended mid-session. When it reopened, it opened at $0.19. Marcus, paralyzed by FOMO and still drunk on overconfidence, held. Then averaged down. Then held more. Three weeks later, his account had $340 left.

Here’s the uncomfortable truth Marcus learned the hard way and the truth this article is built on:

Penny stocks didn’t destroy his account. His emotions did. The stock was just the arena. The real battle was always happening between his ears.

What Are Penny Stocks And Why They Attract Traders

Before you can master the psychology of this market, you need to understand what you’re actually stepping into. Most traders skip this step. They jump to charts and alerts and never stop to ask: why does this asset class feel different from everything else?

Penny stocks are generally defined as shares trading under $5 per share, though many traders use a tighter definition, under $1. They typically trade on OTC markets (Over-The-Counter) rather than major exchanges like the NYSE or NASDAQ, though some low-priced shares do trade on listed exchanges.

Here’s what makes them structurally unique:

Low liquidity means the spread between the bid and ask can be wide, sometimes brutally so. You might buy at $0.42 and find the best sell price is $0.38 before the trade even settles.

Microcap stocks and nano-caps have thin float, meaning the total number of shares available for trading is small. When volume spikes, prices move fast. Very fast.

High volatility stocks in this space can move 50%, 100%, or 300% in a single session. That same volatility can work in reverse just as quickly.

And then there’s the appeal, the asymmetric return potential. A $500 position in a stock that triples becomes $1,500. That math is seductive, especially to traders who feel locked out of traditional wealth-building paths.

But here’s where the pivot matters. The exact traits that create opportunity speed, volatility, low price, are the same traits that create intense psychological pressure. And most traders are nowhere near prepared for it.

Read this: Emotional Discipline in Trading: How to Stay Calm During Drawdowns

Why Penny Stocks Trigger Extreme Emotions

You can have a solid strategy, a clean watchlist, and good intentions. But the moment you enter a penny stock trade, something shifts. Your heart rate changes. Your thinking narrows. The rational part of your brain starts losing the argument to something more primal.

That’s not a weakness. That’s biology. But understanding why it happens is the first step to not letting it run you.

The Lottery Effect

There’s something deeply psychological about a stock trading at $0.28. It feels cheap. It feels like you can’t lose much. And the idea of it going to $2.80, a 10x feels almost… reasonable.

This is what behavioral economists call the lottery effect. Small price, big upside, low barrier to entry. Your brain processes it like a ticket. And just like a lottery ticket, the feeling of possibility overrides statistical reality.

The illusion of easy wealth is one of the most dangerous forces in penny stock trading psychology.

Low Float & Fast Moves

When a low-float stock starts moving, it moves fast. Seconds matter. And that speed creates urgency, a psychological state where you feel you must act now or miss out entirely.

This is FOMO in its rawest form. The ticker is going up. The volume is spiking. Every second you wait feels like money leaving your hands.

Speed is the enemy of clear thinking. And in high volatility stocks, speed is the environment you’re operating in constantly.

Social Media Hype & Pump Culture

Open Twitter, Reddit, or any trading Discord right now. You’ll find tickers being blasted with rocket emojis, screenshots of 500% gains, and language designed to create urgency and tribal belonging.

Herdbehavior is powerful. When everyone around you is buying the same stock and celebrating, your brain reads social consensus as evidence. It short-circuits your due diligence.

This is the pump culture that surrounds day trading penny stocks and it’s engineered to exploit your psychology, not reward it.

Overconfidence After a Big Win

One more thing. And this one is subtle but it’s probably the fastest path to account destruction.

When you nail a trade, when a stock you bought at $0.40 hits $1.20 and you sell perfectly, your brain releases dopamine. You feel sharp. You feel right. And that feeling is a trap.

Overconfidence bias makes you size up your next trade, loosen your stops, and stop questioning your assumptions. You stop following your process because you think you’ve moved beyond needing one.

“The market is a device for transferring money from the impatient to the patient.” — Warren Buffett

The same cycle plays out in penny stock trading thousands of times per day, across thousands of accounts.

Related article: Emotional Biases That Affect Stock Traders and How to Overcome Them

The 5 Psychological Mistakes Penny Stock Traders Make

These aren’t rare mistakes. They’re common. They happen to smart people. They happen repeatedly. Understanding each one, including the psychological bias underneath, is how you start to interrupt the pattern.

Revenge Trading After a Halt

The behavior: A stock halts against you. You take a significant loss. The moment it reopens, you re-enter, not because the setup is good, but because you want to “win back” what you lost.

The bias: Loss aversion combined with ego. The pain of losing is so strong that you’d rather take an irrational risk than accept the reality of the loss.

The correction: Build a rule that after any halt, you do not re-enter the same ticker for the remainder of the session.

Read this article: Revenge Trading: The Hidden Habit That’s Blowing Up Your Account

Averaging Down Blindly

The behavior: The stock drops. Instead of honoring your stop, you buy more, reasoning that the average price is now lower and the “value” is better.

The bias: This is the sunk cost fallacy. You’re making new capital decisions based on what you’ve already lost, not based on what the chart is actually telling you.

The correction: Define your maximum position size before you enter. Never add to a losing trade unless it was part of your plan from the start.

Ignoring Liquidity Risk

The behavior: You buy 20,000 shares of a stock trading 50,000 shares a day. You don’t think about how you’ll exit.

The bias: Focusing only on entry and upside while completely ignoring the mechanics of the exit. This is a form of optimism bias, the assumption that things will go your way.

The correction: Before every trade, check the average daily volume. Ask yourself: if this goes against me, can I get out at a reasonable price?

Position Sizing Based on Emotion

The behavior: You feel really good about a setup, so you go in with 3x your normal size. Your confidence overrides your system.

The bias: Emotional state is being used as a signal for position size, when it should be irrelevant. Risk management in penny stocks starts with fixed, predefined sizing.

The correction: Use a consistent percentage of your account per trade, 1% to 2% is a common professional standard. Your emotional state is not a position sizing tool.

Breaking Stop Losses Under Pressure

The behavior: The stock hits your stop. You move it down “just a little more” because you believe in the trade. Then you move it again.

The bias: This is cognitive dissonance at work. Your belief in the trade conflicts with the market reality, so you change the rule rather than accept the truth.

The correction: Your stop loss is a pre-commitment device. It exists precisely because in the future, you cannot be trusted to make rational decisions under pressure. Honor it.

Read: How to develop a super trader mindset

Emotional Discipline in Penny Stock Trading

This is where growth actually happens. Not in finding better tickers. Not in faster alerts. In building the kind of emotional discipline in trading that allows you to execute your plan even when everything in you wants to deviate from it.

Risk First, Profit Second

Before you ever think about how much you could make on a trade, you need to know exactly how much you’re willing to lose. This isn’t pessimism. It’s a professional trading mindset in action.

Define your dollar risk per trade. Define your maximum daily loss. When you hit it, stop. The market will be open tomorrow. Your account needs to be there when it opens.

Pre-defined Exit Rules

There should be no decision-making happening when you’re in a live, volatile trade. Every exit, both your stop and your target, should be defined before you enter.

Why? Because the moment you’re in a position, your objectivity is compromised. You have skin in the game. Your brain will lie to you. Predefined exit rules remove you from the equation when it matters most.

Detach From Outcome

This one sounds abstract until you experience what it actually means. Detaching from the outcome doesn’t mean you don’t care about results. It means you judge a trade on execution quality, not on whether it made money.

A trade where you followed your rules perfectly and lost money is a good trade. A trade where you broke your rules and made money is a dangerous trade, because it reinforces bad behavior.

“The goal of a successful trader is to make the best trades. Money is secondary.” — Alexander Elder

Trade Smaller Than Your Ego Wants

This is the most practical advice in this entire article. When you find yourself wanting to size up because a setup looks “perfect” go smaller. Not larger.

Your ego wants to be right in a big way. Your account needs you to survive in a consistent way. Trade smaller than your ego wants. Build the habit. Let it compound.

A Framework for Trading Penny Stocks

A mindset without structure is just motivation. And motivation fades. Here’s a working framework you can apply starting with your next session:

Before the Market Opens

Define your setup criteria for the day, what specific technical conditions must be met before you enter any trade. Vague intentions create emotional entries.

Define your maximum loss per trade and your maximum daily loss. Write them down. Not in your head. On paper or in your trading journal.

During the Session

Journal your emotional state before each trade. Rate your confidence, your anxiety, your focus on a scale of 1-10. Over time, you’ll start to see patterns, the emotional states that precede your worst trades.

After the Session

Review your behavior, not just your P&L. Did you follow your rules? Where did you deviate? Why? This weekly behavioral review is where real growth lives. Most traders skip it. That’s why most traders don’t improve.

Penny Stocks vs. Professional Trading

Let’s be direct about something that the hype culture around penny stock trading rarely admits.

The retail gambler approach: Scan for momentum, chase the biggest mover of the day, size up because it “feels right,” ignore the stop, hold through a reversal, and hope.

The structured trader approach: Define a setup. Size appropriately. Enter on confirmation. Honor the stop. Take the target. Repeat.

You don’t need explosive penny stock volatility to build a trading career. You need consistent execution on setups you understand, with risk you can absorb. A trader making 2% per week on a disciplined process will always outlast the trader who made 200% once and then lost it all.

The risks of penny stocks are real. But the bigger risk is believing that the stocks themselves are the variable that determines your outcome. They’re not. You are.

Who Should (And Shouldn’t) Trade Penny Stocks

Not everyone is suited for this market. Being honest about this is one of the most important things a site like The Reborn Trader can do.

Penny stock trading may be a fit for you if you have at least one to two years of active trading experience, you have a written risk management plan you actually follow, you can absorb a daily loss without it affecting your next session emotionally, and you’re drawn to the structure of the game, not just the payout.

Penny stock trading is likely not right for you if you’re brand new to the markets and looking for fast money, your account is undercapitalized to the point where any loss is financially devastating, you notice that losses make you angry, impulsive, or desperate, or you don’t yet have a sustainable trading strategy you’ve tested and trust.

This isn’t gatekeeping. This is respect. The market will give you the same information eventually, it just won’t be as kind in delivery.

Final Lesson

You can have the cleanest setup in the world. You can have a perfectly backtested system, a great penny stock screener, the right alerts, the ideal broker. And still blow up an account.

Because when the stock halts against you, strategy doesn’t step in. You step in. And what steps in with you, your impulse control, your ego, your patience, your fear, determines everything.

Volatility is a mirror. It shows you who you actually are as a trader, not who you think you are.

The market exposes weaknesses. But if you let it, if you stay in the process, keep the journal, honor the stops, trade smaller than your ego wants, it also builds something.

Discipline. Consistency. Identity. That’s the real trade. And it’s available to anyone willing to make it.

Want to master your trading mindset and stop letting FOMO or panic control your decisions?

Join The Reborn Trader Newsletter and get exclusive insights, actionable strategies, and emotional discipline tips delivered weekly. Learn how to trade smarter, stay disciplined, and grow your portfolio with confidence.

Subscribe now and take control of your trading journey.

FAQ

Are penny stocks high risk?

Yes, significantly so. Penny stocks carry elevated risks including low liquidity, wide spreads, limited regulatory oversight, and vulnerability to manipulation. Volatility can work both ways quickly, which is why strict risk management is essential.

Can you make money trading penny stocks?

Some traders do, but most lose. Profitability depends less on stock selection and more on emotional discipline, position sizing, and consistent execution. Without structure, volatility usually wins.

Why do most penny stock traders lose money?

Most losses stem from psychological mistakes: chasing momentum, ignoring stop losses, revenge trading, and oversizing positions. The real issue isn’t the stock, it’s unmanaged emotion.

How do you manage risk in penny stocks?

Define your maximum dollar risk before entering. Use hard stop losses. Avoid averaging down without a plan. Cap your daily loss and stop trading when it’s hit. Risk control isn’t optional here, it’s survival.

How important is trading psychology in penny stocks?

It’s critical. The speed and volatility of penny stocks amplify fear, greed, and overconfidence. Even strong technical strategies fail without emotional discipline and a structured process.