Trading addiction is more common than you think, and it often hides behind ambition and discipline. In this article, I’ll show you how to identify problematic trading behaviour, differentiate between mastery and obsession, and reclaim control of your mindset and performance.

You thought you were in control. One more trade. One more candle. One more dopamine hit.

Now, your chart is the first thing you check in the morning and the last thing at night. Your emotions swing with your PnL. Your “strategy” feels more like survival.

This isn’t trading. It’s addiction with a chart.

You’re not alone. Thousands of traders silently suffer from a dopamine‑fueled obsession that looks like ambition but feels like compulsion.

This article isn’t here to judge. It’s here to expose the trap and help you escape it.

The Fine Line Between Mastery and Madness

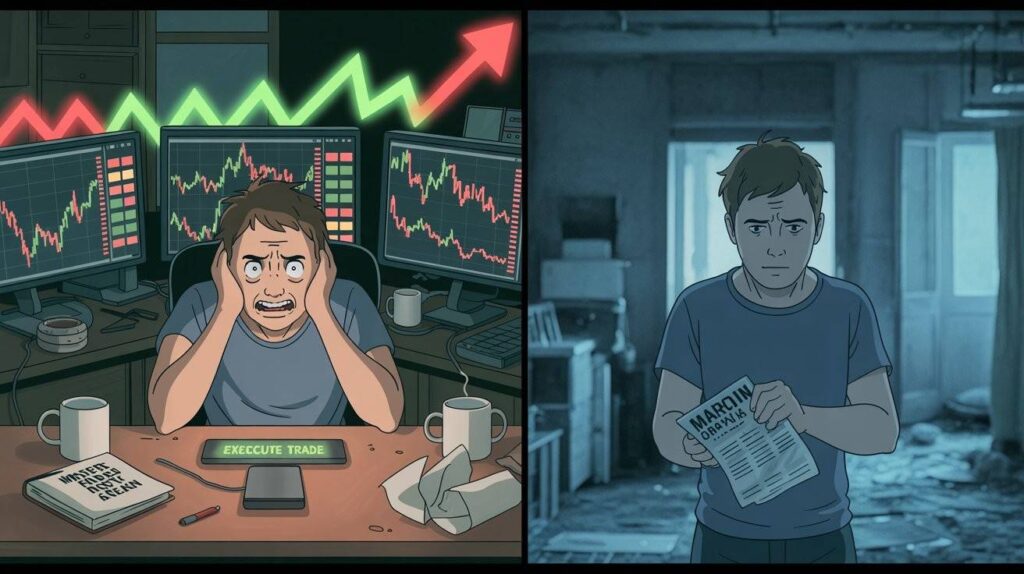

At first glance, two traders might look the same: same screens, same charts, same ambition. But look closer.

One trades with intention. The other trades with compulsion. One is guided by a systematic trading process. The other is driven by emotion. One trades for freedom. The other is unknowingly trapped.

In 2025, research continues to show that many traders fall into the silent grip of the trading addiction mindset, often without realizing it.

This is not just about money. It’s about mindset.

The Dopamine Trap: Trading Feels Like a Casino

Dopamine drives excitement, reward, and motivation but it also fuels behavioral addiction in markets.

Every trade lights up your brain like a slot machine. Win or lose, you get the chemical hit. The anticipation, the movement, the outcome. The cycle repeats.

Trading becomes less about strategy and more about stimulation. When that happens, you’re not trading the markets, you’re trading your nervous system.

Check this out: Investopedia explains how trading can mimic gambling behavior.

The Illusion of Control

You’ve studied the charts. You’ve watched 100 hours of price action. You’ve backtested setups.

Then the trade goes against you. So you double down. That’s ego trying to wrestle the market into submission. Addicted traders believe they can will the market to obey them.

Reality check: the market doesn’t care. You don’t have control, you have process. Cross that line, and you stop being a trader. You become a gambler in disguise.

Read this: Emotional Discipline in Trading

“Trading is a mirror: the market doesn’t cheat you, your mindset does.”

When Passion Turns Into Obsession

You started trading for freedom. Flexibility. Wealth. Now you stare at screens 12 hours a day. You can’t sleep without checking your PnL. You think about candles while brushing your teeth.

You miss birthdays. Snap at loved ones. Your body is slumped. Your brain is fried. This isn’t passion. It’s obsession. Anything done excessively without intention becomes toxic, even trading.

Ask yourself: Are you trading to build a life, or has trading become your entire life?

Are You in Love With Trading or the Rush?

Most addicted traders aren’t in love with the process. They’re in love with adrenaline:

- The rush of the entry

- The thrill of risk

- The chaos of volatility

But adrenaline is not strategy. Emotion is not edge.

As Mark Douglas said in Trading in the Zone:

“If you want to create consistency, you have to start from the assumption that every trade is random.”

Structure, repetition, and patience beat dopamine highs every time.

Addiction vs. Discipline

“Discipline in trading isn’t about avoiding risk, it’s about mastering yourself before the market.”

Here’s a mirror you can use today:

| Trait | Discipline-Based Trader | Addiction-Driven Trader |

|---|---|---|

| Has a plan | ✅ Yes | ❌ No |

| Reviews past trades | ✅ Yes | ❌ Avoids it |

| Takes breaks | ✅ Yes | ❌ Trades daily (even tired) |

| Tracks metrics | ✅ Yes | ❌ Ignores statistics |

| Trades for returns | ✅ Yes | ❌ Trades for stimulation |

| Journals sessions | ✅ Yes | ❌ Rarely or never |

| Checks emotional state | ✅ Yes | ❌ Ignored |

See yourself on the right? You’re not weak, you’re human. But it’s time for a mindset shift.

You Trade for Identity, Not Income

One of the sneakiest forms of addiction is ego attachment. You don’t just trade for money, you trade to feel important. Smart and elite. You post charts every day, check likes, fear not being seen as a trader.

This is identity addiction. Real traders build equity. Addicted traders build ego.

Ask yourself: if trading was banned tomorrow, would you still feel worthy?

Financial Porn: Addicted to Content, Not Mastery

The internet has created a billion-dollar dopamine cycle:

- YouTube gurus

- Discord signals

- Alpha communities

- Twitter threads

You consume constantly, but execution suffers. You’re not learning, you’re binge-watching. This is content addiction disguised as hustle. Growth comes from doing the work, not watching others.

The Hidden Cost of Trading Addiction

It’s not just your account at risk, it’s your life.

- Weekends are stressful.

- Loved ones get snapped at.

- Anxious on green days, empty on red days.

- Health and sleep suffer.

Even if you could earn more in a conventional job, the compulsion to trade dominates.

Check NCBI research on compulsive trading.

The Recovery Mindset: Reclaim Discipline

Recovery doesn’t mean quitting. It means reprogramming your relationship with trading:

- Trade only specific sessions (e.g., NY open)

- Take one full day off screens per week

- Introduce journaling after every session

- Define maximum trades per day

- Practice visualization before entries

Boundaries turn passion into power. Without them, passion becomes poison.

Shift From Addict to Architect

You don’t need to quit trading, you need to build a system:

- Create rules

- Automate processes

- Design routines

- Set outcome-agnostic goals

Addicts chase highs. Architects chase consistency.

You can be the architect of your edge, but only if you stop letting emotions build the house.

Behavioral Finance and the Brain

Peak trading performance isn’t just about charts. It’s about emotional regulation and self-awareness.

- Loss aversion, overconfidence, recency bias, these destroy more accounts than technical errors.

- Treat your mind like an athlete: train emotional fitness, not just trading skills

- Awareness is the first step out of addiction

Final Thoughts: Are You Addicted or Aligned?

No shame in falling into trading addiction. The system is built to seduce. But stepping back, asking hard questions, and rebuilding from the inside out is power.

You can be free. Focused. A real trader. But first, you must break the cycle.

If you want actionable strategies that strengthen your trading mindset, help you manage emotional pressure, and keep you disciplined under any market condition, join The Reborn Trader Newsletter. I share exclusive lessons, mental frameworks, and behind-the-scenes insights, all completely free. It’s the quickest way to boost your emotional control, sharpen your decision-making, and trade with clarity.

Subscribe now and get the next issue delivered directly to your inbox.

FAQs

What is trading addiction?

Trading addiction is a behavioral addiction where individuals feel compelled to trade excessively, often ignoring risk management, personal wellbeing, or financial stability. It’s fueled by dopamine responses similar to gambling addiction.

How do I know if I’m addicted to trading?

Common signs include compulsive trading, ignoring stop losses, emotional mood swings tied to trading outcomes, overtrading without a plan, and prioritizing trading over health, relationships, or responsibilities.

Is trading addiction the same as gambling addiction?

Yes, they share psychological similarities. Both activate the brain’s reward system and create cycles of risk, reward, and obsession. Trading addiction often hides behind the illusion of strategy, making it more dangerous.

Can I recover from trading addiction without quitting trading?

Absolutely. Recovery involves reframing your relationship with trading setting boundaries, following a structured plan, taking regular breaks, journaling, and addressing the emotional triggers behind compulsive behavior.

How can I break the trading addiction cycle?

Start with awareness. Limit screen time, implement strict risk rules, trade only at planned times, and track emotional patterns. Join support communities or mental reset challenges to rebuild discipline and regain control.

Why do traders get addicted to the markets?

The fast pace, high rewards, and constant stimulation trigger dopamine responses that make trading feel emotionally addictive. Traders often chase the rush rather than the results.

Can trading addiction affect mental health?

Yes. It can lead to anxiety, depression, burnout, sleep disorders, and social isolation. Emotional attachment to trading outcomes can deeply impact self-worth and psychological well-being.

What books help with trading psychology and addiction?

Top recommended books include u003cemu003eTrading in the Zoneu003c/emu003e by Mark Douglas and u003cemu003eThe Daily Trading Coachu003c/emu003e by Dr. Brett Steenbarger both offer proven frameworks for mental discipline and emotional awareness.