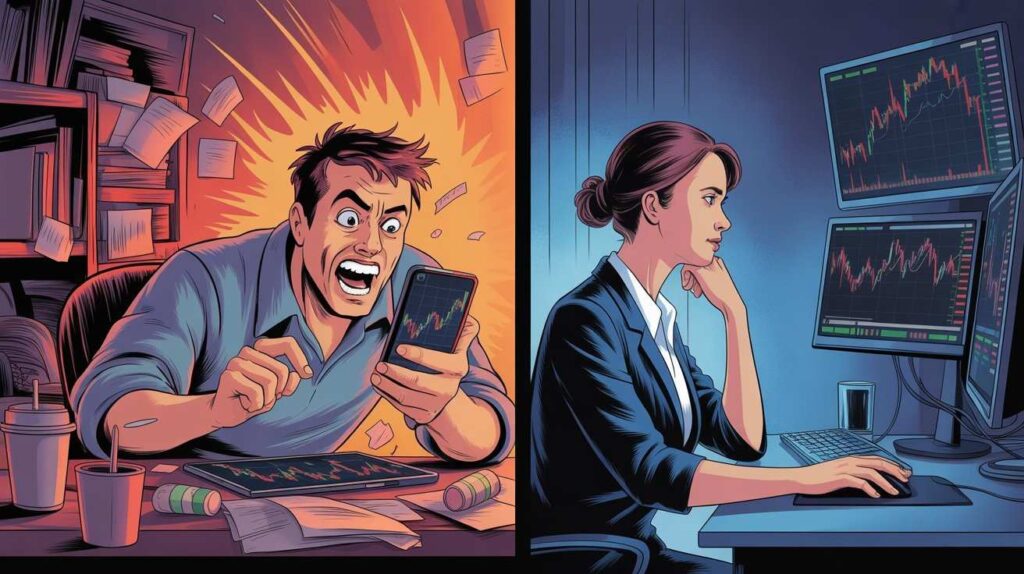

Many traders believe they’re analyzing markets, but they’re really gambling with emotion. The difference lies in mindset trading follows discipline and probability, while gambling feeds on impulse and dopamine-driven thrill.

Understanding this distinction isn’t just about better trades; it’s about rewiring how you think, feel, and behave in the face of uncertainty.

Introduction: The Hidden Illusion of Control

If you’ve ever felt a rush hitting the “buy” button, or chased a loss late into the night, ask yourself this: Am I trading or just gambling in disguise? From the outside, trading and gambling look almost identical. Fast decisions. High stakes. Emotional swings. Both can leave you feeling invincible one moment and broken the next.

But here’s the thing: beneath the surface, they’re powered by two completely different psychological engines.

One is driven by discipline, strategy, and delayed gratification. The other is driven by emotion, compulsion, and the search for a high. And knowing which engine is running your trades determines everything.

The Dopamine Loop in Trading Psychology

“Gamblers seek excitement from uncertainty. Traders seek clarity within it.”

Let’s start with what science says. According to a 2024 study in the Journal of Behavioral Finance, nearly 63% of retail traders overtrade due to dopamine-seeking behavior, the same neurochemical pattern observed in gambling addiction.

When you win a trade, your brain releases dopamine. It feels good. You crave that feeling again.

But when you lose, dopamine drops and your brain urges you to chase the next win to fill the gap.

This reward-punishment cycle is what keeps gamblers at the slot machine and traders glued to their charts.

The difference?

Gamblers know they’re gambling.

Traders convince themselves they’re being strategic.

If you’ve ever justified a revenge trade by saying, “I’m just testing my system,” that’s dopamine talking, not logic.

If this part resonates with you, I share more daily reflections on trading psychology and mindset over on X (formerly Twitter)

The Illusion of Control in Trading

Most gamblers believe they can “beat the odds.”

They wear lucky charms, use rituals, or follow patterns that make them feel in control.

Traders do the same, just in more sophisticated ways.

They tweak indicators after every loss.

They chase entries that “feel right.”

They confuse activity with progress and intuition with edge.

Psychologists call this the illusion of control, the belief that you can influence outcomes that are largely random.

In trading, that illusion is deadly.

Here’s what separates the two:

Gamblers try to control the outcome.

Traders control their inputs their risk, reaction, and routine.

If you can’t control the outcome, but you still act as if you can, you’ve crossed into gambling territory.

The Gambler’s Fallacy: Why Most Traders Stay Stuck

The gambler’s fallacy is the belief that a losing streak means you’re “due” for a win. It’s irrational, but emotionally seductive.

Lose five trades in a row? You double your position size on the sixth.

After all, you have to win soon, right?

But markets don’t owe you symmetry.

Probability doesn’t remember the past. Each trade is independent, no matter how much your ego wants to believe otherwise.

The seasoned trader understands this at a visceral level.

They don’t think in terms of winning or losing today.

They think in terms of long-term expectancy, the edge that emerges only after hundreds of trades.

In short: gamblers think about the next outcome; traders think about the next thousand.

Trader vs Gambler: The Psychology Table

| Psychological Factor | Gambler’s Mindset | Trader’s Mindset |

|---|---|---|

| Motivation | Thrill, hope, escape | Mastery, growth, independence |

| Control | Illusion and superstition | Focus on risk and process |

| Risk Relationship | Seeks risk for excitement | Manages risk for reward |

| Decision-Making | Impulsive, reactive | Systematic, data-informed |

| Loss Handling | Denial, revenge trading | Acceptance and adaptation |

| Time Horizon | Short-term gratification | Long-term consistency |

| Learning Loop | Repeats mistakes | Journals and refines |

| Identity | Self-worth tied to wins | Self-worth tied to discipline |

| Addiction Pathway | Chases emotional high | Pursues performance flow |

| View of Market | Market as opponent | Market as ecosystem |

The Subtle Addiction That Masquerades as “Effort”

Trading addiction doesn’t look like gambling addiction.

There’s no casino, no flashing lights.

Instead, there’s a laptop, a cup of coffee, and a justification that sounds smart:

“I’m just putting in the hours.”

“I need more screen time.”

“I’m improving.”

But here’s the truth: addiction isn’t about the activity; it’s about the emotional attachment to it.

The need to feel engaged all the time, to always be “doing something,” often hides a fear of stillness, the very state real traders thrive in.

You can’t see opportunities if your mind is noisy.

You can’t grow if every click is an emotional fix.

So start here: before every trade, ask yourself, am I chasing clarity or excitement?

One builds wealth. The other burns it.

Ego: The Silent Saboteur

Nothing destroys traders faster than ego.

Early success inflates confidence.

Confidence turns into overconfidence.

Then reality humbles you and the ego can’t take it.

You start trading to prove something. To win back what you lost. To restore identity.

The market doesn’t care. It only reflects your behavior.

As Mark Douglas wrote in Trading in the Zone, “The consistency you seek is in your mind, not in the market.”

And that’s the line that separates professionals from everyone else.

Here’s a simple shift: stop asking, “Did I make money today?”

Start asking, “Did I follow my process today?”

That’s how you anchor your identity in discipline, not outcome.

The Market Isn’t Your Enemy

Gamblers see the market as something to beat.

Traders see it as something to understand.

When you fight the market, you make it personal.

When you observe the market, you make it professional.

This shift in perspective from combat to collaboration, is what turns chaos into structure.

You start realizing the market isn’t unpredictable. It’s just indifferent.

Your job isn’t to conquer it, it’s to align with it.

To read the rhythm without forcing it to dance to your tune.

That’s where patience lives. That’s where mastery begins.

Also read this: The Brutal Truth About TradingView Your Mindset Is the Real Edge

Self-Accountability: The Only Edge That Matters

Here’s what’s funny: every losing trader blames the same things brokers, algorithms, fake news, manipulation.

But ask any consistently profitable trader, and they’ll tell you:

“The problem was me.”

That sentence, though uncomfortable, is liberation.

Because once you take ownership, you regain control.

And in markets, control is power.

Start small: after each trade, note three things, what went right, what went wrong, and what you learned.

That’s not journaling for the sake of it, it’s building awareness, the cornerstone of a professional mindset.

Read next: The Role of Journaling in Trading Psychology

Self-Assessment: Are You Trading or Gambling?

Ask yourself these five questions honestly:

- Do I feel a rush before entering a trade?

- Do I increase size after losses to “get it back”?

- Do I have a clear, written plan I follow every day?

- Do I review my trades weekly?

- Is my mood tied to my P&L?

If you answered “yes” to the first two and “no” to the last three, you’re not trading, you’re gambling.

Awareness is the first win. Change begins with that realization.

How to Rewire from Gambler to Trader

1. Education:

Study market structure, probability, and risk management. Understand how the market actually works.

2. Strategy:

Backtest, journal, refine. Focus on consistent application, not outcome.

3. Risk Management:

Define your daily max loss. Use stop-loss orders. Accept uncertainty.

4. Emotional Discipline:

Meditate. Exercise. Reflect. Learn to respond, not react.

5. Routine:

Start your day with clarity, not charts.

End your day with reflection, not regret.

Consistency compounds, so does chaos.

Read next: How to Stay Calm During Drawdowns

When Trading Becomes Gambling

Trading becomes gambling when:

- You abandon your plan “just this once.”

- You double down after a loss.

- You follow tips instead of systems.

- You trade for excitement, not opportunity.

It’s not the activity that defines the gambler. It’s the mindset behind it.

“Discipline isn’t about control. it’s about surrendering to a process that outlasts emotion.”

Conclusion: The Market Doesn’t Reward Hope

At first glance, trading and gambling look like twins.

But look closer, one is built on discipline, the other on dopamine.

Gamblers seek emotion. Traders seek evolution.

The market doesn’t reward hope or hustle, it rewards consistency.

Not just in charts, but in character.

So the next time you hit that “buy” button, pause.

Ask yourself, which part of me is trading right now, the gambler or the trader?

Because in the end, it’s not the market that decides your fate.

It’s your psychology.

Ready to Shift from Gambler to Trader?

If you’ve seen glimpses of the gambler within you, don’t beat yourself up.

The transition begins with awareness, grows through reflection, and solidifies through discipline.

Here’s your next step:

- Start a trading journal today. Track thoughts, emotions, and patterns.

- Review your last 10 trades. Were they strategic or impulsive?

- Subscribe to The Reborn Trader Newsletter for weekly deep dives on trading psychology and mindset mastery.

Your edge isn’t your indicator. It’s your inner world.

Rewire it and everything changes.

FAQs

What is the difference between trading and gambling?

Trading involves skill, strategy, and risk management, while gambling relies mostly on chance and emotion with little to no long-term edge.

Can trading become gambling?

Yes. Trading becomes gambling when decisions are driven by emotion, lack of discipline, or when risk management is ignored.

Why is trading psychology important?

Trading psychology shapes decision-making, emotional control, and long-term consistency, critical factors for sustainable success.

How can I avoid gambling behavior in trading?

Use a well-tested trading plan, manage risk strictly, and track your emotions and performance through journaling and reflection.

Is trading just a form of gambling?

Not if approached with a disciplined strategy. While both involve risk, trading allows for calculated decisions with positive expectancy.

What mindset separates traders from gamblers?

Traders value process, patience, and risk control. Gamblers often chase quick wins, act impulsively, and let emotions dominate decisions.

How does trading psychology affect profits?

Strong trading psychology improves consistency, avoids emotional mistakes, and ensures better decision-making under pressure.

Why is emotional discipline important in trading psychology?

Emotional discipline is crucial because it prevents impulsive decisions during market volatility. In trading psychology, managing fear, greed, and frustration helps traders stick to their plan, avoid revenge trading, and make rational choices, something gamblers often struggle with due to emotional reactivity.

How can I stop trading like a gambler and develop a professional trader mindset?

Start by tracking every trade, defining risk limits, and building a rules-based strategy. Focus on consistent execution, not quick profits. Journaling, backtesting, and learning from mistakes are key to shifting from a gambling approach to a disciplined, professional trading mindset.

Is trading like gambling?

Trading becomes gambling when there is no edge, no risk management, and no plan. Professional trading is based on probability, statistics, and controlled risk. Gambling relies on hope. Trading relies on execution. The difference isn’t the market. It’s how you approach it.